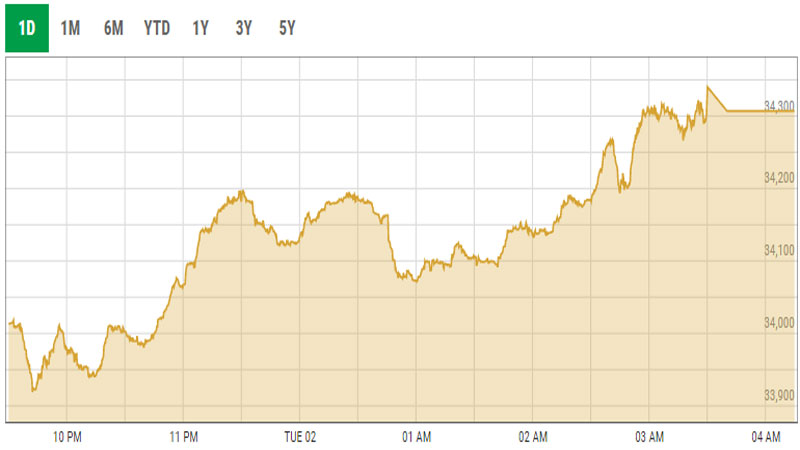

The stock market remained volatile throughout Tuesday’s session, making an intraday low of -77 points and high of +344 points to close at 34,307 level, 311 points above the last trading day.

The stock market remained volatile throughout Tuesday’s session, making an intraday low of -77 points and high of +344 points to close at 34,307 level, 311 points above the last trading day.

Positivity in the market came in the eleventh hour as buyers jumped in to take to cherry pick value buys. Volume traded stood at 91 million as compared to 48 million in the previous trading session.

An equity analyst said that the KSE 100 Index remained positive throughout the session, however most of the gains came in last trading hour of the session due to lower than expected CPI number. According to data released by Pakistan Bureau of Statistics (PBS), the CPI for June 2019 stood at 8.9 percent against consensus expectation of 9.5 percent. Fertiliser, commercial banks and cements were major contributors to the index the day, cumulatively adding 195 points.

Market closed higher as the government believes that it has taken all advance actions agreed with International Monetary Fund (IMF) and that the bailout package worth $6 Billion would be approved in the IMF executive board meeting scheduled tomorrow. Positive sentiments were also fuelled by the appreciation in the value of Pakistani rupee against the US dollar. The US Dollar at the interbank traded 2.05 rupees lower at 158.

On the news front, Saudi Arabia has started supplying oil to Pakistan on deferred payments worth $9.9 billion. Banking space spiked the index where HBL (+1.9%), MCB (+1.1%), NBP (+4.6%) and BAHL (+0.7%) closed in the green zone. Cement and E&P sector closed higher than their previous day close where DGKC (+2.9%), MLCF (+2.8%), CHCC (+3.3%), PIOC (+2.6%), POL (+1.4%) and PPL (+0.7%) were the major movers from the mentioned sectors.

Maaz Mulla, an equity analyst, expects market to remain volatile until the International Monetary Fund (IMF) meeting has been conducted.