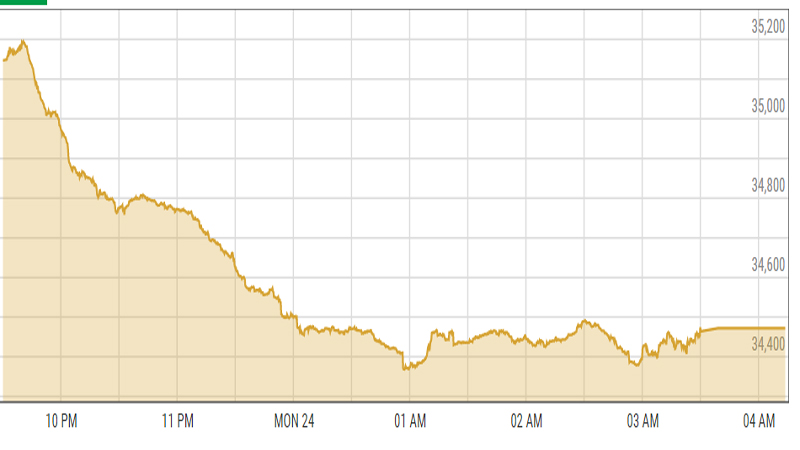

Pakistan equities closed Monday on a bearish note with benchmark KSE-100 Index nose-diving 653 points, closing at 34,472 levels, down 1.9 percent.

Pakistan equities closed Monday on a bearish note with benchmark KSE-100 Index nose-diving 653 points, closing at 34,472 levels, down 1.9 percent.

The local bourse kicked off on a positive note, making a high of +69 points but soon came under pressure to touch a low of -757 points.

An equity analyst ta IIS Securities said the KSE-100 index remained negative throughout the session Monday due to the news that Pakistan has failed to meet FATF deadline of May. FATF may consider further action against Pakistan in October if it fails to curb money laundering activities.

Furthermore, Pakistan is to get USD 3 billion in deposits and direct investment from Qatar. Both countries also signed MoUs on tourism, investment, trade and financial intelligence. E&Ps, cements, fertilizers were major draggers to the index’s losses, collectively shedding 334 points.

The Cement sector came under pressure where LUCK (-5%), FCCL (-6.1%), DGKC (-5%), MLCF (-5%), KOHC (-5%) and CHCC (-5%) closed in the lower circuit as the reports came in of further price cuts in the North.

Moreover oil sector also showed a dismal image despite Oil prices extending gains in the international market prompted by tensions between Iran and the United States.

In the E&P sector, PPL (-2.2%), OGDC (-1.8%) and POL (-2.9%) closed in the red zone. ENGRO (-1.7%) was the major laggard in the Fertilizer sector. In the Financials HBL (-1.7%) was the major laggard. Traded value stood at $18 million, down 31 percent and volume stood at 79 million shares, down 39 percent. Furthermore, major contribution to total market volume came from KEL (0%), TRG (-5.5%), FCCL (-6.1%) and MLCF (-5%).

” We expect market to remain volatile on the economic and political front”, said Maaz Mulla, an equity analyst.