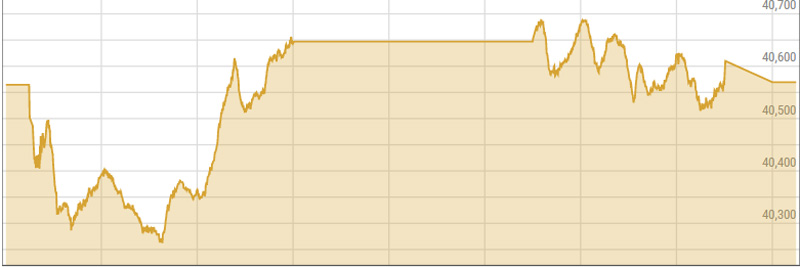

Pakistan Stock Exchange (PSX) lurked for certainty, as investors’ sentiments were dampened amid escalating political tensions and fears of lockdown amid resurgence of Covid-19. On Monday, the benchmark kse-100 witnessed a range-bound session but fell flat, and lost 64.60 points by the closing bell to clock at 40,504.75 index level.

Pakistan Stock Exchange (PSX) lurked for certainty, as investors’ sentiments were dampened amid escalating political tensions and fears of lockdown amid resurgence of Covid-19. On Monday, the benchmark kse-100 witnessed a range-bound session but fell flat, and lost 64.60 points by the closing bell to clock at 40,504.75 index level.

During the session, the index oscillated between negative and positive territory but failed to mark any difference amid a dry spell of dwindling investors’ participation. The Investors’ confidence has been faltering ever since the Covid-19 resurgence has raised the possibilities of another round of lockdown. On Monday, Prime Minister Imran Khan presided over a meeting of the National Coordination Committee (NCC) to devise a strategy to deal with the rising number of coronavirus cases in the country as over 2,400 new cases were reported on Sunday. The NCC meeting is likely to take a decision about early and extended winter vacations in educational institutions as suggested by the Nov 11 meeting of the National Command and Operation Centre (NCOC) to reduce the impact of the disease.

Moreover, investors feared escalation in political uncertainty as National opposition parties have threatened protests in the aftermath of defeat in the Gilgit-Baltistan elections. Meanwhile, the opposition alliance Pakistan Democratic Movement (PDM) is set to increase the political-ante and is determined to continue holding anti-government rallies across the country. During the session, the market also failed to respond to positive economic trigger, as Country’s Foreign direct investment (FDI) surged 151percent year-on-year to $317.4 million in October 2020, compared with $126.5 million in the same month of last year, data released by the State Bank of Pakistan (SBP) showed on Monday. Cumulatively, FDI during the four-month (July-Oct) FY21 period jumped nine per cent to $733 million compared to $672 million in 4MFY20.

At kse-100, the index volumes decreased from 120.4 million shares recorded in the previous session to 115.8 million shares, while the overall market volumes were recorded at around 181.45 million shares, drastically decreasing from the previous session’s volumes of 243.1 million shares.

The volume chart was led by K-Electric Limited followed by Maple Leaf Cement Factory Limited and Sui Northern Gas Pipeline Limited. The scrips exchanged 24.91 million, 14.49 million and 14.17 million shares, respectively.

Sectors that dented the index were Oil & Gas Exploration Companies with 46 points, Textile Composite with 29 points, Cement with 19 points, Technology & Communication with 10 points and Refinery with 6 points. Among the scrips, most points taken off the index was by Pakistan Petroleum Limited which stripped the index of 22 points followed by Oil & Gas Development Company Limited with 19 points, Lucky Cement Limited with 19 points, Systems Limited with 10 points and Kohinoor Textile Mills Limited with 9 points.

However, the sectors which resisted the pressure were Power Generation & Distribution with 21 points, Commercial Banks with 15 points, Fertilizer with 11 points, Pharmaceuticals with 8 points and Oil & Gas Marketing Companies with 7 points. Among the scrips, most points added to the index was by United Bank Limited which contributed 22 points followed by K-Electric Limited with 11 points, Fauji Fertilizer Company Limited with 10 points, Fauji Cement Company Limited with 10 points and Hub Power Company limited with 10 points.