All heads are turned towards the Parliament as Finance Minister Shaukat Tarin presents the budget 2021-22.

The finance minister was greeted with high enthusiasm from opposition benches, with members shouting slogans and taunting him as he praised PM Imran Khan’s economic initiatives and said that the incumbent government doesn’t hesitate to take difficult decisions.

He explained how the economy was destabilized due to the Corona pandemic but the government succeeded in combatting both the issues.

Tarin lashed out at the previous governments, saying that a mountain of circular debt amounting to Rs1.2 trillion was inherited by the incumbent government despite payments of Rs 4.8 billion due to inefficient policies.

“We made the [capacity] payments otherwise the country would have defaulted,” he said. “I am presenting you the real picture, not to highlight our performance but to create a benchmark,” added the minister.

He said the incumbent government had, through its sound economic policies, turned around the current account deficit of $20 billion into a surplus of $800 million in 2021 while a 3.6% primary deficit reduced to 1%.

The minister paid tribute to the PTI government for stemming the spread of the coronavirus pandemic and taking steps to ensure businesses did not suffer massive losses in the country due to the lockdowns.

“The government, through the Ehsaas Emergency Cash Programme, provided cash to 12mn people across the country and helped a total of 15 mn people across the state,” he said.

“During this time, exports were contracting and there was over a 100% increase in imports,” Tarin added. “Despite this context, a 5.5% growth rate was recorded.”

Remittances have increased in Pakistan to record levels and are expected to rise to $29bn by the end of this month.

Further, the gross income from bumper crops has been recorded at Rs 3100 billion as compared to last year estimates of Rs 2300 billion, showing a 32% increase in incomes to farmers who own agricultural land under and equal to 12.5 acres.

Despite the pandemic, the per capita income of the common man has increased by 15%.

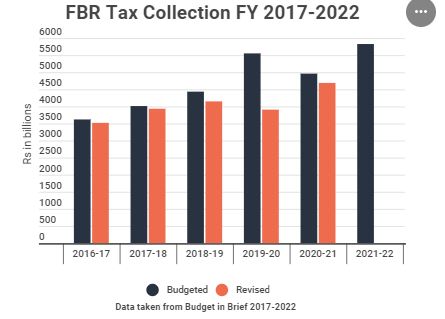

Speaking about tax collection, he said it had grown by 18% and had crossed Rs4,000bn, adding that critics had no response to the government’s impressive performance in this regard.

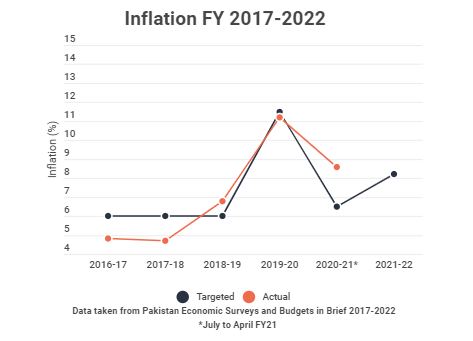

For the upcoming fiscal year, the government targets to keep inflation at 8.2pc, which is significantly higher than the 6.5pc targeted for FY21.

The highlights in the current FY:

- Tax payers increased by a number of 312,000 and an increase of Rs 5.1 trillion of tax returns were recorded.

- 14% increase in exports due to rebates and subsidies.

- Prices of oil, wheat and sugar have been increased by 45%, 27% and 18% respectively in the local markets while the rest were absorbed.

- A fall witnessed in public debt from 87% due to controlled spending, increase in tax revenues and an improved exchange rate.

- A growth rate of 4.8% set for the coming fiscal year.

- A transformational plan to ensure food security and ensure a growth rate of 6-7pc to employ the 65pc labour force that is below 30 years.

- Defense budget of Rs 1370bn had been allocated which is 16pc of total expenditure budgeted for FY22, down from 18pc last year.

- Allocation of Rs682bn for subsidies to various sectors of the economy and a Rs479bn allocation to run the civil government.

- Tax collection target for the Federal Board of Revenue (FBR) at Rs5,829 billion for FY22, which is 17.4pc higher than last year’s Rs4,963 billion.

- Small cars up to an engine capacity of 850cc may be exempted from value-added tax besides reducing sales tax rate on these from 17pc to 12.5pc.

- Federal excise duty on telecommunication is being reduced from 17pc to 16pc.

- Rs900 billion allocated for federal PSDP

- Minimum wage has been increased to Rs20,000

- Rs12 billion allocated for agriculture sector

- Rs118 billion for power distribution

- Rs61 billion for Viability Gap Fund

- Rs14 billion for Climate Change mitigation projects

- $1.1 billion for vaccines procurement

- Rs100 billion for Covid-19 Emergency Fund

- Rs12 billion special grant for Sindh

- Rs 33 billion for low cost housing schemes

- Rs 100 billion for housing loan schemes

- Rs 260 billion for Ehsaas Programme/Poverty Alleviation Fund

-

Rs 100 billion earmarked for emergencies

-

Rs 160 billion for salaries and pensions

-

Non-tax revenue has been set at Rs 2,080 billion.

-

Revenue from privatization is estimated at Rs 252 billion

-

T-Bills and Sukuk are estimated to fetch Rs 681 billion

- Rs 91 billion for three major dams, Diamer Bhasha, Mohmand and Dasu

- Completion of the Lahore-Karachi motorway

- Rs 40 billion for the socio-economic development of Gilgit-Baltistan

- Rs 20 billion outlay for Southern Balochistan

- Rs 118 billion for the achievement of Sustainable Development Goals

- Rs 100 million allotted for introduction of Anti-Rape fund by the Prime Minister

Key fiscal targets

- The overall outlay of the budget is expected at Rs 8 trillion with an expected fiscal deficit of 5.5% to 6% of GDP for FY22 compared to an estimated deficit of 6pc of GDP during FY21.

- The revenue collection target for FBR has been set at Rs5.8 trillion for FY22, which will be lower than IMF’s target of Rs6 trillion. Still, the target seems to be ambitious, as it is likely to be 23% higher compared to the estimated collection of Rs4.7tr in FY20-21.

- Additional revenue measures worth Rs350 billion are also expected.

- The non-tax collection target will be set at Rs1.42tr.

- For FY22, the government is expected to earmark Rs900bn for the federal PSDP, an increase of 38pc from the previous budget. A key element is total development outlay, which includes provincial spending. It is expected that the government will set a provincial spending target of Rs1tr, taking the total development outlay to Rs1.9tr compared to last year’s budgeted outlay of Rs1.3tr (up 44pc).

- Government is likely to set mark-up interest and defense expenditure targets at Rs3.1tr and Rs1.4tr, up 4pc and 9pc from last year’s budget, respectively.

- The government also intends to increase salaries and pensions by 15-20%.

- The fiscal deficit is expected to be around Rs2.9tr in FY22 which could be 5.6pc of the GDP.

- For subsidies, the government is expected to set a target of Rs530bn for FY22.

- The current account deficit for FY22 is projected to be around $2.3bn which would be less than 1pc of the GDP.

- The cotton bales output expected for FY22 would be around 10.5m bales.

- The government may also earmark funds for Covid-19 to procure more vaccines in the upcoming year. According to a government statement, it has spent $250m for procuring vaccines in FY21 and the upcoming budget will see an enhanced amount for this purpose.