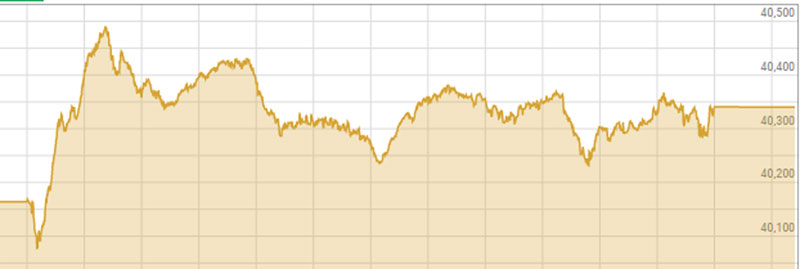

Pakistan Stock Exchange witnessed a range bound session on the first trading day of the as benchmark Kse-100 index closed at 40,340.17 index level after gaining 176.15 points by the session’s closing.

Pakistan Stock Exchange witnessed a range bound session on the first trading day of the as benchmark Kse-100 index closed at 40,340.17 index level after gaining 176.15 points by the session’s closing.

On Monday, the index began the decent ascension right after the opening bell, as investors treaded cautiously amid rising political noise and upcoming Financial Action Task Force (FATF) review which will drive the pace of the future course of market trend. During the session market witnessed some fresh buying as value hunters continue to accumulate over sold stocks at attractive rates, in anticipation of result quarterly financial results season.

However, investors participation remain dim as equity investors continued to weigh in political uncertainty after as Pakistan Democratic Movement (PDM), a coalition of nearly dozens of political parties geared held large political gatherings over the weekend to ramp up pressure on the government. Analysts believe, political tension in the country remained one of the major reasons for diminishing market participation despite robust economic figures and strengthening Rupee against U.S dollar.

Moreover, investors will closely monitor the developments around the virtual plenary of the FATF, to be held on October 21-23, which will take the final call on Pakistan’s continuation on its grey list after a thorough review of Pakistan’s performance in fulfilling the global commitments and standards in the fight against money laundering and terror financing. Investors are expecting Pakistan to avoid the black list and stay in grey list, since out a total of 27 action plan obligations given by anti-money laundering body, Pakistan has so for cleared 21. However, raising optimism, earlier this month, Pakistan’s Foreign Minister Shah Mehmood Qureshi said, Pakistan would participate in the virtual meeting on the FATF to be held in Paris, and hoped that Pakistan would be on the white list of the FATF soon. Qureshi also mentioned that America and some other countries would support Pakistan on FATF.

During the day, the benchmark KSE-100 Index remained in the green zone throughout the session and touched intra high at 40,491.13 after it gained 327.11 points in early trade, however, the index pared some early gains in the afternoon, and dropped to its intraday low at 40,077.90 after it lost 86.12 points.

The index volumes, however receded during the day as market participation at kse-100 increased from 155.50 million shares recorded in the previous session to 182.42 million shares , while the overall market volumes also increased from 254.2 million shares from the previous session to 319.56 million shares.

The volume chart was led by Unity Foods Limited, followed by Pakistan International Bulk Terminal Limited and Fauji Foods Limited. The scrips exchanged 53.66 million, 36.64 million and 26.74 million shares, respectively.

Sectors which lifted the index were Fertilizer with 88 points, Oil & Gas Exploration Companies with 31 points, Oil & Gas Marketing Companies with 19 points, Transport with 15 points and Vanaspati & Allied Industries with 14 points. Among the scrips, most points added to the index was by Engro Corporation Limited which contributed 62 points followed by Engro Fertilizers Limited with 23 points, Mari Petroleum Company Limited with 20 points, Meezan Bank Limited with 16 points and Pakistan International Bulk Terminal Limited with 15 points.

However, sectors which continued to add pressure on the index were Commercial Banks with 15 points, Tobacco with 5 points, Cement with 5 points, Power Generation & Distribution with 4 points and Insurance with 3 points. Among the scrips, most points taken off the index was by Habib Bank Limited which stripped the index of 13 points followed by Muslim Commercial Bank with 12 points, Pakistan Oilfields Limited with 5 points, Pakistan Tobacco Company Limited with 5 points and National Bank of Pakistan with 5 points.