PSX Index remains range-bound amid lack of triggers

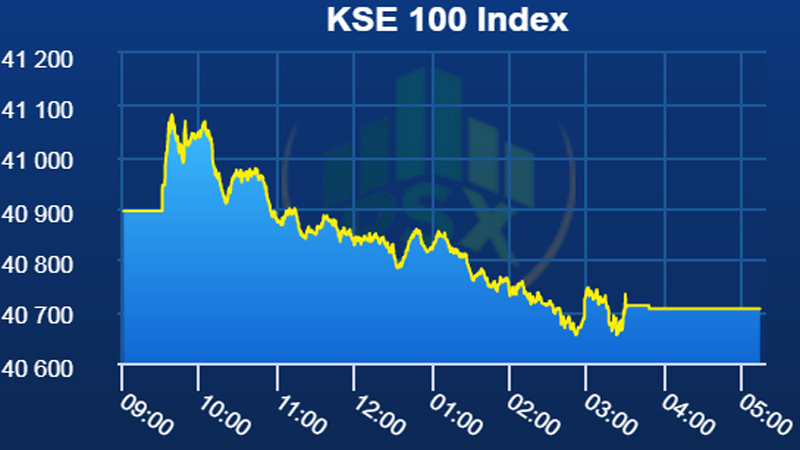

KARACHI: The stock market closed on a negative note on Wednesday as investors preferred to stay on sidelines ahead of MSCI Re-balancing due on Friday. The benchmark index shed 189 points, down 0.5 percent from the previous trading session.

The KSE-100 opened on a positive note, continuing on an upward trajectory, making a high of +187 points. However, it slid in the second half of the trading session to close at 40,705 levels. On the news front, The Economic Coordination Committee (ECC) has constituted an inter-ministerial committee comprising Power Division, Law Division and Finance Division to prepare repayment plan of upto Rs 200 billion structured Islamic financing facility to be arranged from a consortium of six banks led by Meezan Bank against WAPDA, GENCOs and Discos assets.

Volumes remained subdued with 124 million shares traded during the day. K-Electric gaining 4.61 percent and Siddiqsons Tin Limited (STPL) gaining 4.65 percent led volumes with more than 20 million shares changing hands. K-Electric shines as Economic Coordination Committee (ECC) deliberated on the outstanding dues of the company as well as its claims from different government entities before reaching a conclusion on the issuance of NOC for the sale to Shanghai Electric Limited (SEL).

Refinery sector closed lower than its previous day close on back of the news that oil refineries fear shutdown as slow off-takes of furnace fuel oil following the government’s shift to gas based power production have left them with the key product surfeit and that can break down their entire supply chain.

National Refinery Limited (NRL), Attock Refinery, and Byco were the major loser of the mentioned sector.

Pak Suzuki Motor Company (PSMC) gaining 4.80 percent closed at its upper circuit on back of the news that the Company is planning to set up its second assembly plant at Port Qasim, Karachi.

The construction of second plant will increase company’s manufacturing capacity by additional 100,000 vehicles per year.

Selling was witnessed in Cement, Banking and E&P sector in which major stocks like DGKC (-0.79%), LUCK (-0.80%), HBL (-1.15%) UBL (-0.94%) PPL (-1.15%) & POL (-0.51%) closed negative.

An analyst at Elixir Research Murtaza Jafar expects market to remain range bound due to lack of triggers.

Published in Daily Times, November 29th 2018.

Recent Posts

- Pakistan

Pakistan requests extra 10 bln yuan on China swap line, says finance minister

Pakistan has put in a request to China to augment its existing swap line by…

- Pakistan

- World

Trump-backed crypto venture partners with Pakistan to boost blockchain adoption

The Pakistan Crypto Council (PCC) on Saturday partnered with World Liberty Financial (WLF), a decentralised…

- Pakistan

Pakistan seeks impartial probe into Pahalgam attack

Prime Minister Shehbaz Sharif on Saturday said Pakistan was open to any "neutral and transparent"…

- Pakistan

- World

Defence minister warns of ‘all-out war’

Defence Minister Khawaja Asif has told the New York Times in an interview that Pakistan…

- Pakistan

UNSC calls on members to cooperate

In a related development, the UN Security Council (UNSC) has condemned "in the strongest terms…

- Pakistan

- World

Trump says India, Pakistan will sort out tensions

India and Pakistan will figure out relations between themselves, US President Donald Trump said on…

Leave a Comment